Where traditional finance is centralized—meaning government-backed (or “fiat”) currency, stored in some Big Bank—Web3 is decentralized. In Web3, you can take full ownership of your assets, a decentralization powered largely by cryptocurrencies and blockchains.

But this decentralization means Web3 users have an important choice about where to safely store their crypto. While there are custodial options, another, arguably more secure option is to hold assets in a crypto wallet that only you control—a concept known as “self custody.”

Some compare self custody to keeping assets (like gold or cash) in a safe rather than a bank. A better comparison is that self custody is like being your own bank. With self custody, you alone have the ability to manage (or transact with) your assets. And you can still reap the benefits of crypto: It’s natively digital, accessible 24/7, gives near-instant settlement times, and easily transacts across borders.

To understand the details and benefits of self custody in crypto, it’s first important to know what “custody” means, and how it differs from “storage.”

Understanding the difference between “storage” and “custody” in the crypto world

While this language isn’t exact, you can think of cryptocurrency as being stored on a blockchain network; for all intents and purposes, that’s where the assets actually “live.” Those who have access to those assets are said to have “custody.” But to explain custody, we first need to understand how crypto assets are minted (or newly created).

How crypto assets are created and distributed to wallets

When new crypto assets are minted, they’re distributed to crypto addresses according to the rules of the network (that’s when Bitcoin miners or Ethereum validators receive their “rewards” for upholding the network). Every crypto asset in existence, then, is assigned to some crypto address—even if it’s not accessible (like the infamous ETH burn address). That means someone owns, for example, every bitcoin (BTC) or ether (ETH) in existence. Once minted, it’s impossible for there to be “unclaimed” assets (i.e. those that aren’t linked to a crypto address or smart contract).

What is crypto custody?

Meanwhile, each crypto address has an associated private key, which grants control over the assets that are stored in that address. Whoever has control of that private key is said to have “custody” over the assets (thus the maxim—common in Web3 circles—that says “not your keys, not your crypto”).

A crypto wallet, then, doesn’t actually “store” your crypto assets (that happens on their respective blockchains); rather, the wallet stores your private keys. To manage the assets in your crypto address through a crypto wallet interface, you’ll need to give it access to your private keys (often by importing your recovery phrase). For this reason, it’s important to only enter your recovery phrase into a secure, trusted self-custody wallet provider (like Brave Wallet).

While it’s not a perfect analogy, you can think of a blockchain network like a self-storage complex. Using this analogy, we can (hopefully) clarify the core concepts:

- Crypto address: Your crypto address is your individual storage unit within the complex; you can fill it with anything you want.

- Private key: Your private key is like the physical key to the padlock on the storage unit—it’s the only thing that can open the door. Whoever has that key has complete control of the storage unit (or crypto address) and all the stuff inside.

- Self custody: Self custody is like keeping the padlock key in your pocket; only you have access to the stuff inside the storage unit.

- Third-party custody: Third-party custody, by contrast, is like giving the key to the manager of the self-storage complex—they hold it, and you trust they’ll give it back when you ask. (This is essentially what happens with a centralized exchange.)

- Crypto wallet: To complete the analogy, when you import your private key to a self-custody crypto wallet, you’re basically creating a copy of the storage-unit padlock key—another way to access the stuff inside. (As you can imagine, you’d only want to do this with a trustworthy wallet provider.)

Crypto asset custody and the element of trust

In the Web 2.0 financial system, we trust centralized entities like banks and governments with our assets. When you deposit money in a bank, you give a third party control (or custody) over your assets, trusting that the bank will have that money ready for you to withdraw later. If for some reason the bank doesn’t, you trust that it’s insured and that your government will reimburse your losses.

Instead of trusting banks and governments to provide custody, Web3 can put you directly in control of your assets. While centralized crypto exchanges (CEXs) have cropped up to provide easy on-ramps and custody for crypto, the true spirit of Web3 is about self custody. After all, trusting a CEX means trusting a centralized corporation that’s (in many ways) just as opaque as a bank. And, of course, there is still some centralization in Web3, which presents its own unique set of risks (just consider the recent blowup of the FTX centralized exchange). But self custody gives you another option—and a new set of security considerations.

With a self-custody wallet, you’re solely responsible for the security of your assets, because you alone control the private keys. (Note that before CEXs existed, all crypto wallets were self-custody.)

The tradeoff is clear: Self custody means you don’t need to trust banks, governments, or CEXs, but you do need to trust the decentralized systems you choose to use. You’re solely responsible for guarding your private keys against loss and theft.

The two types of crypto custody: self custody and third-party custody

In crypto, there are two main types of custody: third-party custody and self custody. It all comes down to who controls a crypto address’s private keys.

Pros and cons of third-party crypto custody

Third-party custodians are most often CEXs. These entities are (usually, though not always) regulated and licensed in their jurisdictions, should have some sort of insurance for user deposits, and are required to follow Know Your Customer (KYC) and Anti-Money Laundering (AML) processes. In this regard, CEXs are very bank-like, giving users some familiarity and confidence in the services they provide.

Though they weren’t always around, CEXs are now the main way for new crypto users to buy with fiat currencies like the US dollar. They provide a much-needed service for the crypto industry, serving as crypto on-ramps. CEXs make it easy to purchase crypto with a debit card or bank account.

CEXs also offer large amounts of trading liquidity between assets, which means CEXs can often easily handle large trades without disrupting a trading market. Withdrawing five million dollars of BTC from Coinbase, for example, won’t deplete their reserves, or unduly impact prices or the trading experience for other users.

To recap, the main benefits of CEXs include:

- Some bank-style protections and—occasionally—some form of insurance

- A convenient on-ramp for new crypto users

- High trading liquidity

A common complaint about these benefits, however, is that they mostly apply to newbies (convenience) or high-net worth individuals (liquidity and some bank-style protections). For many everyday crypto users, the utility of CEXs doesn’t outweigh the risks. And even some self-custody wallets now have on-ramp providers to enable users to buy crypto assets directly with fiat without ever needing to use a CEX.

The major downside of CEXs (and third-party crypto custody in general), is blind trust. Users must trust custodians to keep assets safe, and act in a user’s best interests. To not lend out user funds without consent. To not go bankrupt and lose user funds (as in the case of Celsius), or commit outright fraud (as in the case of FTX). While regulation aims to prevent this type of harm, it often falls short, and individual users are stuck with the loss.

Pros and cons of crypto self custody

Self-custody is a concept as old as crypto itself. Long before CEXs, the only way to acquire an asset like BTC was to mine it yourself or through a direct peer-to-peer transfer (facilitated by a payment service like PayPal). CEXs only later gained popularity for their added level of convenience. These days, though, users can buy crypto with fiat directly from many self custody wallets, including Brave Wallet.

The main downside of self custody is that it’s more technical than third-party custody. It requires that you keep track of your own private keys (or recovery phrases). That includes protecting them from theft, and from events like floods and fires. But the added complexity of self custody is arguably well worth it: You can own and safely store your crypto without relying on any intermediaries.

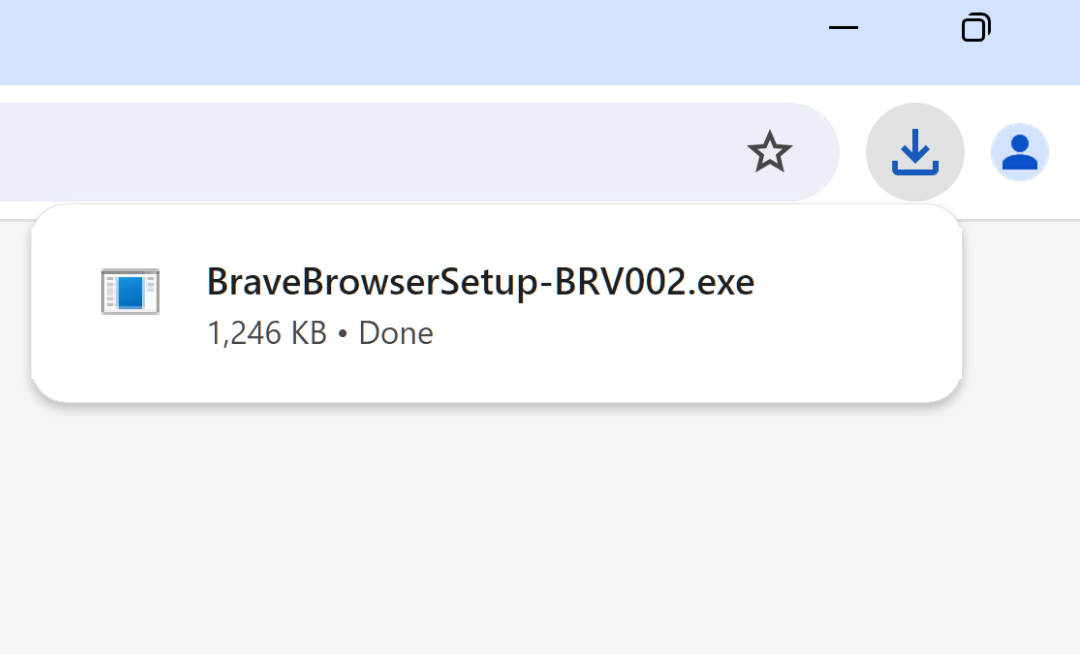

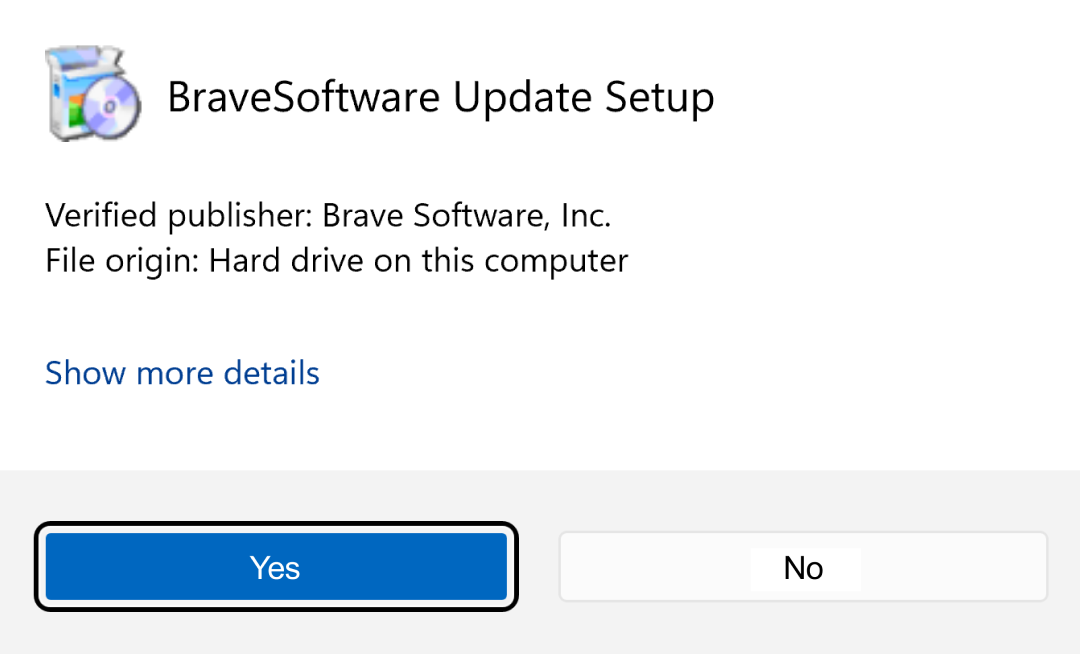

Most often, self-custody crypto wallets will come in the form of a “hot wallet,” which is connected to the Internet. Hot wallets are typically available as standalone apps, extensions for your Web browser, or as browser-native wallets (like Brave Wallet). Hot wallets store your private keys, and act as a kind of digital passport for users to connect to decentralized apps (“DApps”), and fully explore the offerings of Web3, like decentralized finance, gaming, and social media.

A CEX-hosted crypto address, by contrast, can’t connect to DApps on Web3—it’s like a centralized, watered-down version of a self-custody wallet.

One other benefit of self custody is that you can also use a “cold wallet,” which is a physical device (similar to a USB drive) that enables you to securely store your private keys offline. People often treat hot wallets like keeping some cash in their pocket, and cold wallets like a home safe for more funds.

To recap, the main benefits of self-custody wallets include:

- Ownership of private keys

- Control of your assets

- DApp connectivity

- Cold (or offline) storage options

Crypto custody isn’t one-size-fits-all

Choosing how to custody your crypto is an important decision that doesn’t have one right answer. Your custody preferences may change over time, or as your portfolio grows. What works best for a crypto novice probably won’t suffice for an expert. And, most importantly, many users choose to use multiple methods—keeping smaller balances in a hot wallet for quick access, larger balances in offline cold storage (with separate recovery phrases from their hot wallet), and using a self-custody wallet to access the world of Web3. As with traditional stocks, this diversification provides an additional safeguard against failure of any one custody method.

If you’re looking for extra security, or to explore a self-custody crypto wallet, try Brave Wallet. It gives you complete control of your crypto assets, right in your browser.