Update (Six Months of Data): lessons for growing publisher revenue by removing 3rd party tracking

This note presents lessons for all publishers based on six months of data from Dutch publisher NPO, after it removed 3rd party tracking.

Additional revenue data from the Dutch publisher NPO reveals the real-world impact on the revenues of websites of various sizes of removing 3rd party adtech and tracking.

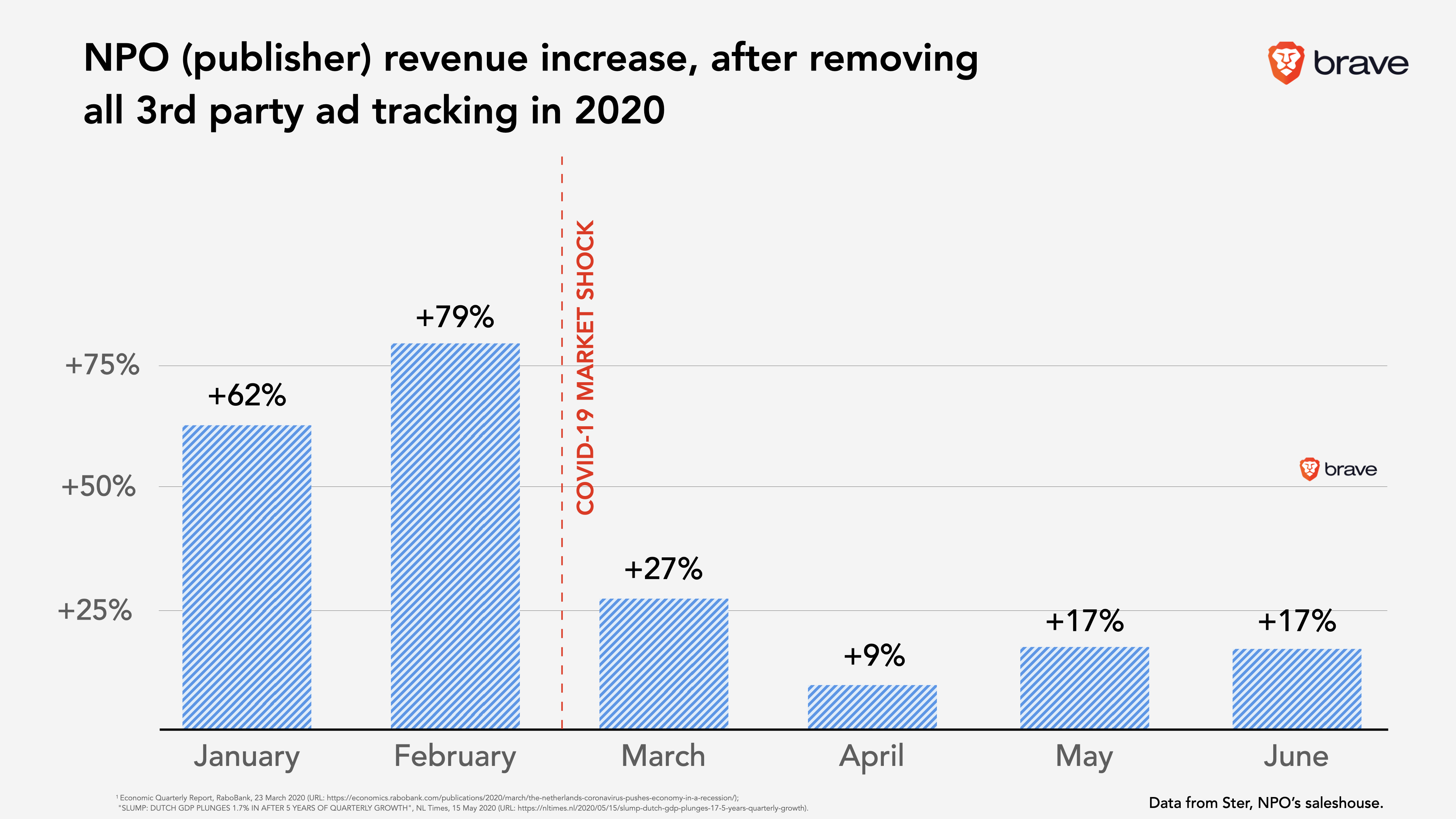

As a previous note outlined, NPO removed third party tracking from its websites at the start of 2020, and sold advertising exclusively by using contextual targeting. The previous note revealed that NPO and its sales house, Ster, enjoyed a leap in revenue as a result.

This update adds the month of June 2020, allowing a six month view of the publisher’s revenue increase, and slightly updates and increases the previously published figures for the first five months of 2020.

An irony is that now that NPO and Ster have shown what is possible with private advertising, the Dutch Government is considering making NPO entirely taxpayer-funded in the coming years.

Finding 1: the revenue increase is attributable to removing 3rd party tracking and adtech

NPO and its sales house, Ster, invested in contextual targeting and testing, and produced vast sales increases even with sites that do not appear to dominate their categories. This may be a tribute to Ster’s ability to sell inventory across NPO’s media group as a collective, but this benefit would have applied in 2019 and does not account for the revenue jump in 2020. A publisher does not therefore need to have market dominance to abandon 3rd party tracking and reproduce NPO’s vast revenue increase.

Finding 2: legitimate publishers of all size can increase revenue

Legitimate publishers of all sizes should be able to follow this example. Although it is a national broadcast group, NPO websites do not dominate the web traffic rankings in the Netherlands.

Only one of NPO’s properties (Nos.nl) ranks in the top 5 in its category in the Netherlands, according. To Similar Web.1 None of the other NPO properties are in the Netherland’s top 100.2 The other NPO websites for which Similar Web provides a traffic rank estimation (versus other websites in the Netherlands) range from 180th to 5,040th most popular in the Netherlands.3 (Addendum: the table below also includes statistics from NOBO, which uses census data from their own panel and counts the amount of times this panel visits different websites.)

NPO properties’ popularity or market position in each content category are not correlated with increases in impressions sold. Country site rank, category site rank, and numbers of page views, vary widely between the properties, whereas the increases in impression sold are all above 83%, with one explicable4 exception.

Table: NPO properties ranked by page views

| NPO property | Increase in impressions sold, %5 | Country rank6 | Rank in content category7 | Reach8 | Page views9 |

|---|---|---|---|---|---|

| nos.nl | 86% | 18th | 3rd (“News”) | 4,390,000 | 216,481 |

| blauwbloed.eo.nl | 71% | no data | 1st (of 2) (“Royals”) | 793,000 | 6,030 |

| nporadio1.nl | 98% | 419th | 3rd (“Music”) | 1,127,000 | 4,280 |

| kro-ncrv.nl | 83% | 744th | 1st (of 1) (“Dating”) | 593,000 | 3,770 |

| avrotros.nl | 12% | 180th | 8th (“Entertainment”) | 1,119,000 | 3,689 |

| funx.nl | 80% | 1,296th | 4th (“Music”) | 790,000 | 3,526 |

| vpro.nl | 92% | 610th | 19th (“Music”) | 769,000 | 3,168 |

| nporadio2.nl | 96% | 997th | 5th (“Music”) | 699,000 | 2,874 |

| home.bnnvara.nl | 92% | 206th | 18th (“Entertainment”) | 288,000 | 1,510 |

| wnl.nl | 89% | no data | 38th (“News”) | 365,000 | 1,474 |

| nporadio4.nl | 99% | 2,960th | 12th (“Music”) | 269,000 | 1,281 |

| 3fm.nl | 94% | no data | 13th (“Music”) | 247,000 | 1,173 |

| bvn.nl | 97% | no data | 20th (“Entertainment”) | 153,000 | 820 |

| powned.tv | 88% | 5,040th | 48th (“News”) | 62,000 | 299 |

| omroepmax.nl | 92% | 4,539th | 8th (“Opinion”) | 54,000 | 190 |

Though Nos.nl accounted for 76% of all impressions sold on NPO properties, the fourteen other NPO websites accounted for the remainder enjoyed an almost identical increase in sales. For example, Powned.tv (ranked 5,040th in the Netherlands) had an increase of 88%; Nos.nl (ranked 18th) had an increase of 86%.

Finding 3. Context is powerful.

NPO properties now provide no geotagging, no frequency capping, and no cross device measurement. Despite the absence of these features, extensive testing with advertisers has proven that the ads are effective, and advertisers are spending more with NPO than before.10 Note that there are methods11 to achieve some of these things in a privacy preserving manner, but NPO has not implemented them so far.

NPO invested in creating descriptive meta data about each item on which ads could be sold. This included mining the subtitles displayed on video content. As Ster testing with advertisers had shown, NPO’s contextual targeting is effective.12

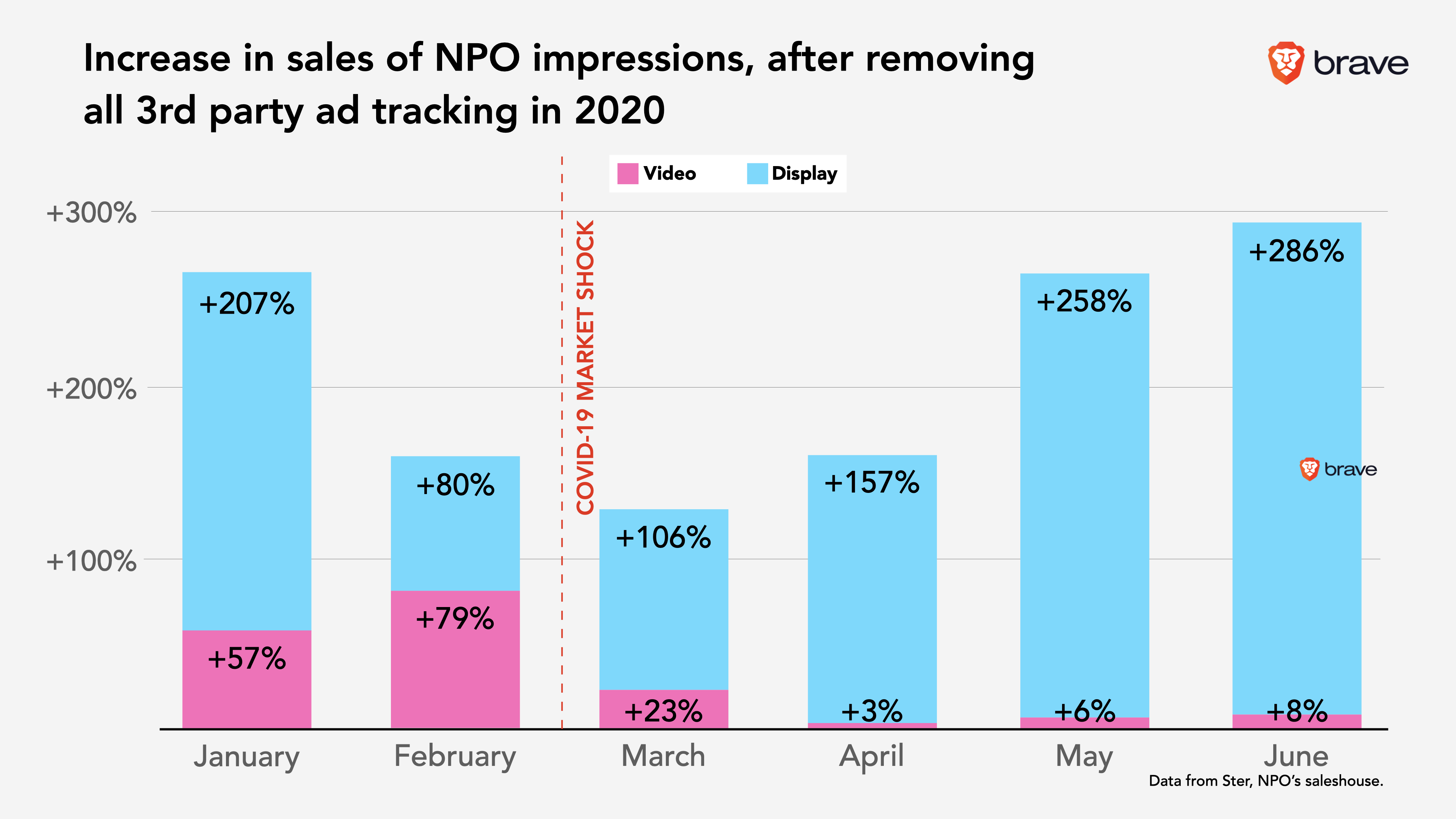

Finding 4: The Covid-19 market shock shifted the market from video to display

In March 2020 the Netherlands experienced an economic shock from the Covid-19 pandemic. Dutch economists predicted a recession.13 Even so, NPO’s strategy of removing 3rd party adtech and tracking continued to yield significant revenue growth over the same period the previous year.

The Covid-19 market shock changed the balance of video to display impressions sold. Sales of display impression increases were enormous. The increase in the sale of video impressions was significant but far lower than in the pre Covid-19 period. This may be attributable to a general decline in ad spending by major brands, which seems to have been a world-wide phenomenon.14

Over the first six months of 2020, for which the latest data are available, sale of display impressions grew by 174% and sale of video impressions grew by 26%.

Conclusion

Two elements appear to be necessary to follow NPO’s example.

First, whatever the size of the publisher, the NPO example proves the benefit of adopting sophisticated contextual targeting.

Second, smaller publishers may benefit from engaging with reputable sales houses that can aggregate supply as Ster does for NPO’s various properties. Publishers of all sizes will benefit according to their reputations – unless advertisers and agencies purchase from sales houses with poor reputations.

I testified some time ago at an international gathering of political leaders that conventional adtech was “a cancer eating at the heart of legitimate publishers”. I was referring to the following five harms:

- theft, commodification, and arbitrage of legitimate publishers’ audiences and audience data;

- enabling a business model for the bottom of the web by harm 1;

- depression of publishers’ prices by harms 1 and 2;

- enabling “adfraud” that operates by spoofing cross-site tracking; and

- opaque adtech tax.

Now, with the benefit of data from six months of impression sales and revenue we can now see the positive effect of cutting away the cancer: NPO is far more lucrative now than in 2019. Year-over-year revenue growth continued even as Covid-19 decimated the advertising market.

At the W3C, colleagues (primarily from across the adtech industry) are currently developing proposals to maintain tracking in the future when third party tracking cookies are no more. As I have told my colleagues at the W3C, this is a fool’s errand that contorts logic and law in the hope of maintaining a system whose disappearance is inevitable. It is also an errand entirely in the service of the adtech industry, to the disadvantage of publishers large and small.

I and my colleagues at Brave urge our industry colleagues to develop a serious Plan B for when tracking goes away.

Plan B is simple: stop tracking people all over the web. This has the benefit of generating more revenue for legitimate publishers, and cutting off a revenue stream for “ad fraud” criminals. Removing 3rd party tracking also has the benefit of lawfulness under the GDPR, and of being future proofed for the forthcoming California Privacy Rights Act.